As a whiz with numbers and a knack for storytelling, I’ve got the scoop on Morgan Stanley Advisor John Rochester. Turns out, he’s in hot water over a FINRA arbitration claim. Picture this: a customer is chasing him for a whopping $600K in damages. And guess what? This isn’t a secret. It’s right there in plain sight for all to peek at. Now, you’ve got me hooked. I dove headfirst into the detective work by Haselkorn & Thibaut on Mr. Rochester’s shenanigans.

FINRA is the regulatory backbone that keeps brokers and brokerage firms in check. They mandate that instances of disputes, complaints, and any regulatory discipline must be recorded in a broker’s BrokerCheck profile, which is where I found out about Mr. Rochester’s situation. It’s a place where transparency meets accountability – brokers can’t hide their financial skeletons here, whether that’s a past bankruptcy or any debts they’ve stumbled upon.

If you’re sitting on any information about Mr. Rochester or if you suspect you’ve been caught up in investment fraud, I urge you to reach out to Haselkorn & Thibaut, P.A. at 1-800-856-3352.

What is unauthorized trading?

Let’s get down to brass tacks. Unauthorized trading happens when a broker makes a move – buying or selling securities – without getting the green light from their client. Not only is this frowned upon, but FINRA outright forbids it. In the finance world, trust is the currency, and unauthorized trading bankrupts that trust.

(AD) Lost money because of bad financial advice or outright fraud? You may get it back by filing a complaint. Haselkorn & Thibaut has 50+ years of experience and a 98% success rate. Don’t delay if you’ve suffered losses. (AD) Lost money because of bad financial advice or outright fraud? You may get it back by filing a complaint. Haselkorn & Thibaut has 50+ years of experience and a 98% success rate. Don’t delay if you’ve suffered losses. Call Haselkorn & Thibaut at 1-888-784-3315 for a free consultation, or visit InvestmentFraudLawyers.com to schedule. No Recovery, No Fee. |

A broker’s handshake must be firm, and their word must be dependable. They’re supposed to discuss potential trades with the investor before making any moves. The only exception is if you’ve given your broker full discretion – a big leap of faith, I’d say.

Here’s a tidbit: There are specific rules, like FINRA Rules 2510(b) and 2020, which draw a clear line in the sand – discretionary trades are off-limits in non-discretionary accounts. If a broker crosses that line, they’re playing with fire because it’s not only unfair, but it’s straight-up fraudulent.

Warren Buffett once said, “It takes 20 years to build a reputation and five minutes to ruin it.” Unauthorized trading might not sweep away those 20 years in five minutes, but it’ll definitely put a dent in that trust. And trust me, in some states, the rules on unauthorized trading are even stricter.

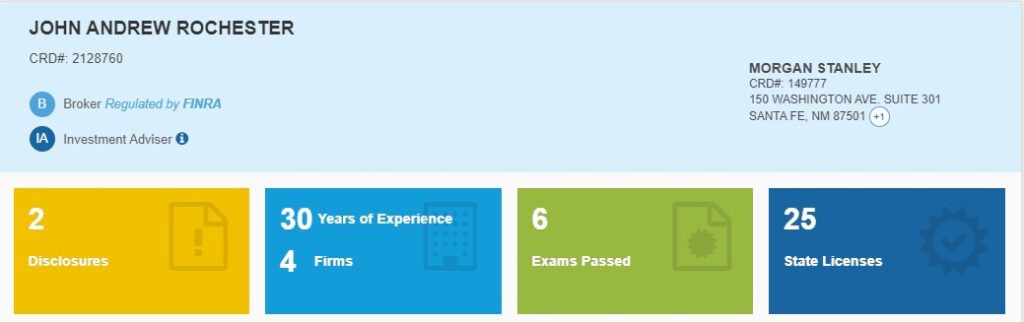

John Rochester’s profile

Here’s the lowdown on John Rochester:

– Started at Morgan Stanley in June 2009

– By January 2021, he’s facing allegations of misrepresenting a variable annuity to a customer, ending with the customer forking out over $60K to settle.

– Fast forward to October 2021, and there’s a new FINRA case (21-2264), where a customer accuses him of unauthorized trades, and she’s not just upset; she’s seeking $600K!

Customer advisory

If you’ve had dealings with John A. Rochester, or any broker whose actions don’t seem to add up, remember: FINRA offers an arbitration process to help investors like you. They’re your ally in seeking damages for any misconduct that may have led to your financial losses.

Haselkorn & Thibaut stand as a bastion for investors from all walks – with presence in New York, Texas, Florida, Arizona, and North Carolina, they’re vested in helping investors recover those losses through FINRA’s arbitration, and they’re doing it nationwide.

Ever heard the phrase “No win, no fee”? That’s how they operate. You’re not shelling out attorney fees unless there’s a favorable outcome – your money recovered. I recommend having a confidential chat with one of their seasoned securities attorneys.

For professional assistance, don’t hesitate to dial 1-800-856-3352.

And a quick financial truth while we’re on the subject: It’s been found that bad financial advisors have cost Americans roughly $17 billion a year in retirement savings. That’s why checking your advisor’s FINRA CRM number is not just smart – it’s necessary for safeguarding your investments. Stay informed, stay protected.