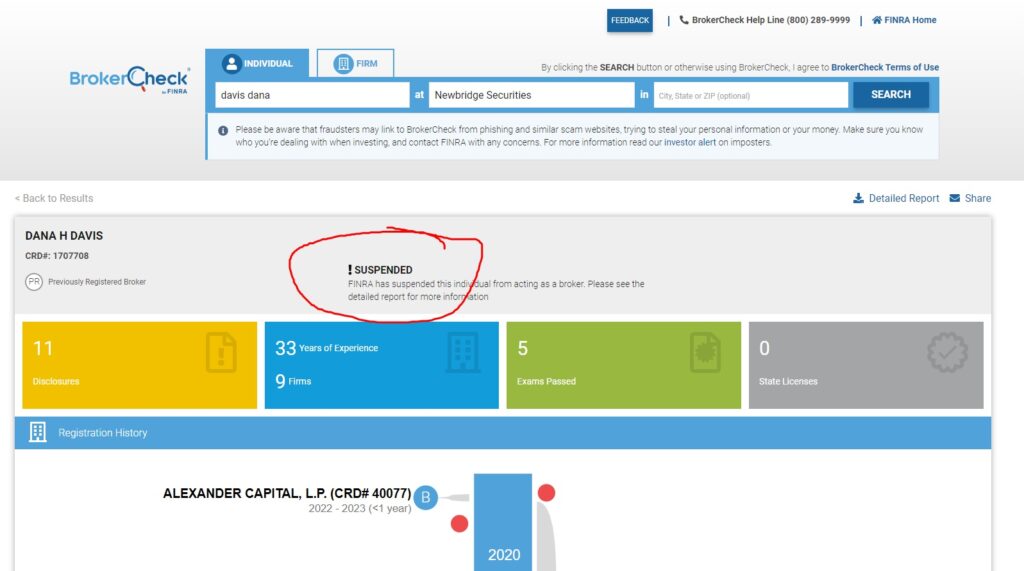

As a financial analyst and writer, I’ve encountered numerous cases of financial malpractice, but the suspension of a broker like Dana Davis from Newbridge Securities Corp. underscores the importance of due diligence in the financial industry. Davis, who has 33 years of experience, faced a 12-month suspension and was obliged to pay $75,000 in restitution after FINRA’s accusations stating he improperly used margin trading with inexperienced investors, leading to heavy losses and fees.

Davis’s three clients, including two pastors and a police officer, lost significant amounts of money due to a large number of margin trades made in their accounts. In one instance, a pastor saw a trading loss of $93,676.24 over 37 months with 457 trades, almost all on margin. This and the other cases brought to light result in violating FINRA’s rules on investment suitability and professional conduct.

Without admitting to or denying the allegations, Davis accepted the suspension and restitution payment. Moreover, FINRA opted not to fine him further, citing his limited ability to pay. Neither Davis nor Newbridge Securities, where he was not recently employed, provided comments on the situation. His professional history includes registration with multiple firms before his latest position and a litany of customer complaints primarily centered around unsuitable or unauthorized trading.

Who is Dana Davis?

Davis has been affiliated with several firms, offering investors an array of products and services. His recent professional trouble casts a shadow over his decades-long career.

(AD) Lost money because of bad financial advice or outright fraud? You may get it back by filing a complaint. Haselkorn & Thibaut has 50+ years of experience and a 98% success rate. Don’t delay if you’ve suffered losses. (AD) Lost money because of bad financial advice or outright fraud? You may get it back by filing a complaint. Haselkorn & Thibaut has 50+ years of experience and a 98% success rate. Don’t delay if you’ve suffered losses. Call Haselkorn & Thibaut at 1-888-784-3315 for a free consultation, or visit InvestmentFraudLawyers.com to schedule. No Recovery, No Fee. |

Customer Complaints and Lawsuits

The BrokerCheck records kept by FINRA reveal that Davis has faced numerous customer complaints, including accusations of unsuitable high-frequency trading activities. A concerning number of these disputes have ended with settlements, reflecting a possible pattern of questionable practices.

Dispute 1

- Date: 8/18/2021

- Status: Settled

- The customer accused excessive concentration and misrepresentation, requesting $50,000 in damages and settling for $14,999.

[…]

Seeking Legal Assistance

If you’re facing investment losses due to actions taken by Dana Davis, it’s vital to understand your legal rights and options. Firms like Haselkorn & Thibaut specialize in defending investor interests and offer free consultation to assess your case.

As someone deeply ingrained in the finance and legal sectors, I cannot stress enough how crucial it is to verify the background of any financial advisor you seek to engage with. To that end, I encourage checking an advisor’s FINRA CRM number for peace of mind. The story of investors with Davis serves as a chilling reminder that “The investor’s chief problem—and even his worst enemy—is likely to be himself,” as Benjamin Graham astutely noted.

And here’s a financial fact that might surprise you: A staggering number of investors do not check their financial advisor’s record before investing. According to a study, 65% of investors did not verify their advisor through a state or federal database. This lack of due diligence can have severe repercussions, as evidenced by cases like Davis’s.

In summary, the case of Dana Davis highlights the potential hazards when financial advisors fail to uphold the standards of their profession. It serves as a powerful lesson on the importance of maintaining ethical trading practices and the need for investors to diligently research and monitor those entrusted with managing their wealth. Remember, your finances deserve careful handling by a trusted, competent advisor who consistently acts in your best interest.